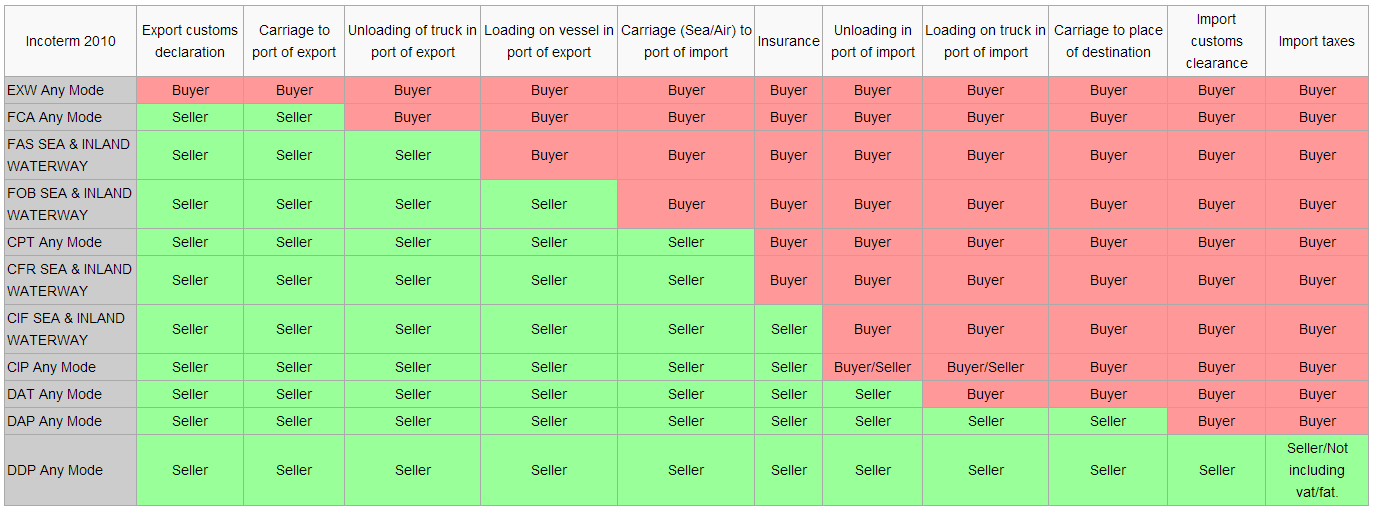

The Incoterms rules or International Commercial Terms are a series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) that are widely used in International commercial transactions or procurement processes. A series of three-letter trade terms related to common contractual sales practices, the Incoterms rules are intended primarily to clearly communicate the tasks, costs, and risks associated with the transportation and delivery of goods.

General Transport.

The four rules defined by Incoterms 2010 for international trade where transportation is entirely conducted by water are as per the below. It is important to note that these terms are generally not suitable for shipments in shipping containers; the point at which risk and responsiblity for the goods passes is when the goods are loaded on board the ship, and if the goods are sealed into a shipping container it is impossible to verify the condition of the goods at this point.

EXW – Ex Works (named place of delivery).

The Seller makes the goods available at his/her premises. This term places the maximum obligation on the buyer and minimum obligations on the seller. The Ex Works term is often used when making an initial quotation for the sale of goods without any costs included. EXW means that a buyer incurs the risks for bringing the goods to their final destination. The seller does not load the goods on collecting vehicles and does not clear them for export. If the seller does load the goods, he does so at buyer's risk and cost. If parties wish seller to be responsible for the loading of the goods on departure and to bear the risk and all costs of such loading, this must be made clear by adding explicit wording to this effect in the contract of sale.

The buyer arranges the pickup of the freight from the supplier's designated ship site, owns the in-transit freight, and is responsible for clearing the goods through Customs. The buyer is responsible for completing all the export documentation. Cost of goods sold transfers from the seller to the buyer.

FCA - Free Carrier (named place of delivery).

The seller to deliver goods to a named airport, terminal, or other place where the carrier operates. Costs for transportation and risk of loss transfer to the buyer after delivery to the carrier.

When used in trade terms, the word "free" means the seller has an obligation to deliver goods to a named place for transfer to a carrier. Contracts involving international transportation often contain abbreviated trade terms that describe matters such as the time and place of delivery and payment, when the risk of loss shifts from the seller to the buyer, and who pays the costs of freight and insurance.

CPT – Carriage Paid To (named place of destination).

The seller pays for carriage. Risk transfers to buyer upon handing goods over to the first carrier at place of shipment in the country of Export. Buyer fully responsible for arranging carrier payment of freight for same Export clearance in Exporting country and Import clearance in Importing country. not responsible for buying Insurance.

This term is used for all kind of shipments.

CIP – Carriage and Insurance Paid to (named place of destination).

The containerized transport/multimodal equivalent of CIF. Seller pays for carriage and insurance to the named destination point, but risk passes when the goods are handed over to the first carrier. CIP is used for intermodal deliveries & CIF is used for Sea Mode.

DAT – Delivered at Terminal (named terminal at port or place of destination).

This term means that the seller covers all the costs of transport (export fees, carriage, insurance, and destination port charges) and assumes all risk until after the goods are import duty/taxes/customs costs.

DAP – Delivered at Place (named place of destination).

Can be used for any transport mode, or where there is more than one transport mode. The seller is responsible for arranging carriage and for delivering the goods, ready for unloading from the arriving conveyance, at the named place. Duties are not paid by the seller under this term(An important difference from Delivered At Terminal DAT, where the buyer is responsible for unloading.)

DDP – Delivered Duty Paid (named place of destination).

Seller is responsible for delivering the goods to the named place in the country of the buyer, and pays all costs in bringing the goods to the destination including import duties and taxes. The seller is not responsible for unloading. This term is often used in place of the non-Incoterm "Free In Store (FIS)". This term places the maximum obligations on the seller and minimum obligations on the buyer. With the delivery at the named place of destination all the risks and responsibilities are transfered to the buyer and it is considered that the seller has completed his obligations

Sea and Inland Waterway Transport.

The four rules defined by Incoterms 2010 for international trade where transportation is entirely conducted by water are as per the below. It is important to note that these terms are generally not suitable for shipments in shipping containers; the point at which risk and responsiblity for the goods passes is when the goods are loaded on board the ship, and if the goods are sealed into a shipping container it is impossible to verify the condition of the goods at this point.

FAS – Free Alongside Ship (named port of shipment).

The seller delivers when the goods are placed alongside the buyer's vessel at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that moment. The FAS term requires the seller to clear the goods for export, which is a reversal from previous Incoterms versions that required the buyer to arrange for export clearance. However, if the parties wish the buyer to clear the goods for export, this should be made clear by adding explicit wording to this effect in the contract of sale. This term can be used only for sea or inland waterway transport

FOB – Free on Board (named port of shipment).

The seller must advance government tax in the country of origin as off commitment to load the goods on board a vessel designated by the buyer. Cost and risk are divided when the goods are actually on board of the vessel. The seller must clear the goods for export. The term is applicable for maritime and inland waterway transport only but NOT for multimodal sea transport in containers (see Incoterms 2010, ICC publication 715). The seller must instruct the buyer the details of the vessel and the port where the goods are to be loaded, and there is no reference to, or provision for, the use of a carrier or forwarder. This term has been greatly misused over the last three decades ever since Incoterms 1980 explained that FCA should be used for container shipments.

It means the seller pays for transportation of goods to the port of shipment, loading cost. The buyer pays cost of marine freight transportation, insurance, unloading and transportation cost from the arrival port to destination. The passing of risk occurs when the goods are in buyer account. the buyer arranges for the vessel and the shipper has to load the goods and the named vessel at the named port of shipment with the dates stipulated in the contract of sale as informed by the buyer .

CFR – Cost and Freight (named port of destination).

Seller must pay the costs and freight to bring the goods to the port of destination. However, risk is transferred to the buyer once the goods are loaded on the vessel. Insurance for the goods is NOT included. This term is formerly known as CNF (C&F, or C+F).

CIF – Cost, Insurance and Freight (named port of destination).

Exactly the same as CFR except that the seller must in addition procure and pay for the insurance.